How to Buy Call Options

How to Purchase Call Options – Making Your First Options Trade

In this tutorial, you will learn how to buy call options in Thinkorswim, how to manage a call position, get out of a call position, set up a limit order, and how read and analyze a P&L statement. The video below covers these concepts using an AAPL trade example.

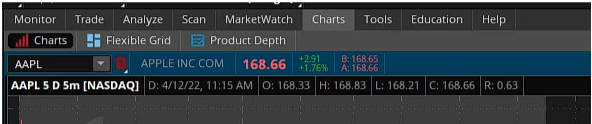

1. To get starting buying a call option, first, navigate to the options chain in Thinkorswim, click on the “Trade” tab at the top of your screen (it’s between ‘Monitor’ and ‘Analyze’). This will populate multiple options chains with different expirations listed in chronological order.

2. If you’ve never utilized the options chain, it will load up a default of 4 strikes that you’re able to view. What you want is to change that number to expose more relevant strikes that can be used in your trading analysis. In the video, the example we use is 20!

3. The left side of the chain will show calls, and the right side will show puts. For this example let’s bring our attention over to the left side of the chain!

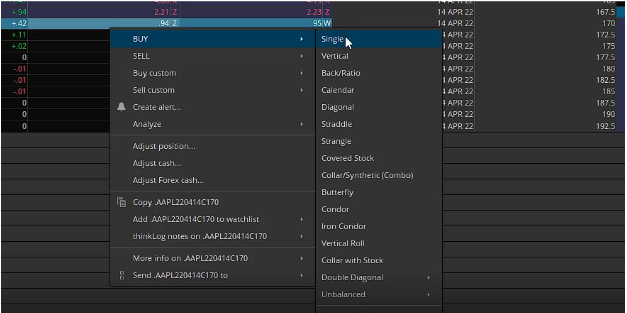

We will be focusing on the 170 strike call. To cue the call-up, right-click on the options row, hover over “BUY,” and then click “Single.”

This will cue up the order window at the bottom of the screen. Make sure to adjust your quantity to your desired size. Most likely it will start with a default of 10, and that could possibly be an inappropriate position size for you.

4. Regarding the order type, we do a limit order in the video. The reason for using a limit order is that it protects you from paying more than desired on a particular trade. If we were to use a market order, the ideal scenario is we get filled within the bid and the ask, but often (especially in volatility) you can get a really bad fill that diminishes the risk/reward of the trade upon entry.

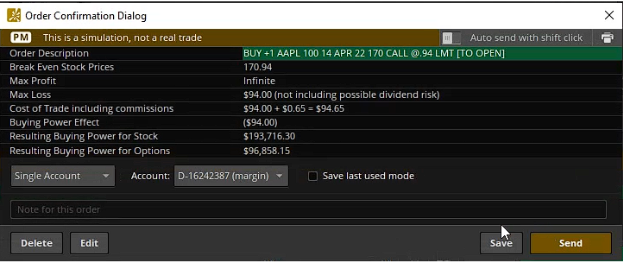

5. After we get the order ready, the next step is to send it! Upon clicking confirm and send, an order window will pop up. It might look a bit more intimidating than it truly is.

6. When buying a call, the max loss you can take on the trade is the price you paid for it. Theoretically, your max profit on the trade is infinite should the underlying financial instrument that the option is a derivative of would continue to accelerate in price. One more click of “Send” and your order is sent!

7. To view your position, you can either click on the “Position” tab at the bottom of the screen, or on the “Monitor” tab right next to the “Trade” tab to view your position. Both give you the same info, so whatever works for you!

8. Now we’re ready to close the trade! We will navigate back to the options chain, highlight that same strike, and now we will choose “SELL” instead of “BUY” and then choose “Single.” This will populate the order window similar to how it was before, but now it will be colored red.

9. Then it is time to confirm and send the order! Congratulations on learning how to buy call options!

If you want to learn more, join Simpler Trading in the Simple Free Trading Room. Sign up today, and join a community of traders led by a professional trader who can guide and mentor you through a trading session. Don’t trade alone!