What Are Put Options?

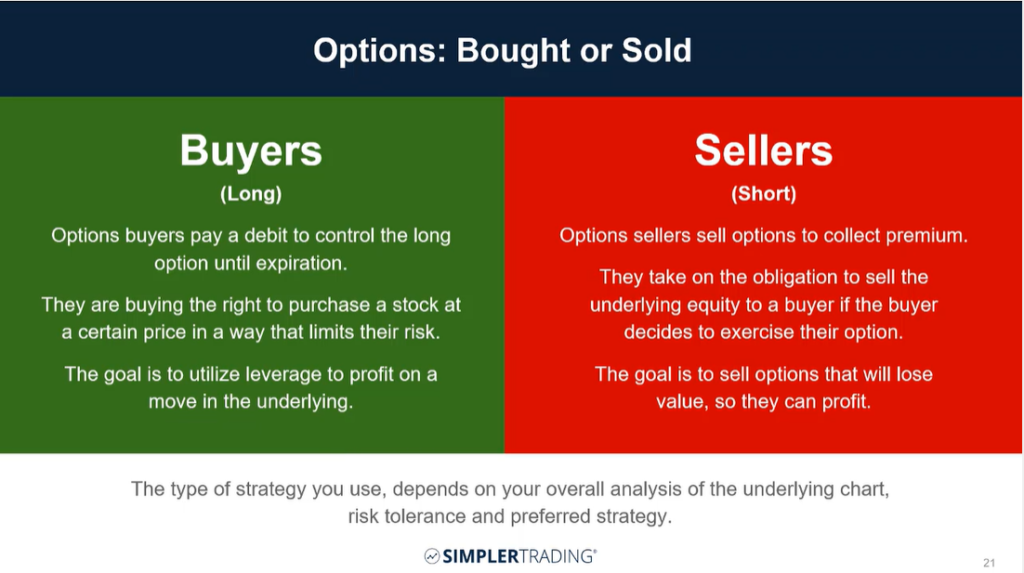

A put option is a financial contract that gives the buyer the right, but not the obligation, to sell an underlying security at a specific price during a specified period of time. A trader can either buy or sell a put options contract.

If a put option is purchased or long, it’s known as bought-to-open. If a put option is sold or short, it’s known as sold-to-open. A call option is the opposite of a put option. A long call option contract increases in value if the underlying asset’s price increases above the strike price.

Key Takeaways

- A put option is a financial contract that gives the buyer the right, but not the obligation, to sell the underlying security at a specific price during a specified period of time.

- If purchased, a long put option will be in the money if the underlying asset price is lower than the strike price.

- If sold, a short put option contract will have in the money if the underlying asset’s price stays higher than the strike price.

- For options trading, a trader will sell (to close) the put option contract when profit targets are met vs. exercising the contract and taking possession of the underlying asset.

How Do Put Options Work?

Simply put, a put option contract price increases when the underlying asset price decreases. The put option contract provides a trader or investor with the right to sell the underlying asset at a specified price, known as the strike price. A put option becomes profitable when the underlying asset price falls below the strike price. When a put options contract is in the money, it may be sold (executed) during the specific time of the contract.

Two components affect the value of an options contract: intrinsic value and extrinsic value.

Intrinsic Value

The intrinsic value of an options contract is the difference between the strike price and the underlying asset price. In a put option contract, the intrinsic value of the contract increases when the underlying asset price decreases. If the underlying asset price is below the contract strike price, the put option contract has intrinsic value.

Extrinsic Value

Extrinsic value is the difference between an options contract market price and the intrinsic value. Extrinsic value is highly related to the contract’s Theta, or how much time is left in the contract. Put options contracts are also more sensitive to Vega, or the underlying asset’s implied volatility price. If the underlying asset price is nearing a critical date, such as earnings, the implied volatility may increase in the weeks before the earnings announcement. This increase of the extrinsic value would be a function of the Vega.

Why Use Put Options?

There are many uses for put options, making them a powerful tool for your trading arsenal. Two primary purposes used for put options are hedging and price speculation. Two main components affect the price of the put options contract.

Hedging- If an investor, hedge fund, or institution holds a long position in a stock and expects a temporary price decline, they may purchase a long put options contract to offset any potential loss.

Speculation – Traders may use put options contracts as part of a directional play or a spread. If the underlying asset is expected to move lower, a trader may buy a put option to profit from the intrinsic and extrinsic value change. A trader may also sell put options contracts and benefit from theta decay. This is known as a short put.

Long Put vs. Short Put

Long Put

A long put is a put options contract that has been bought-to-open. A put options contract is purchased when the underlying asset is expected to decline in price. A long put options contract is sold-to-close the position. A trader makes money on a long put when the value of the stock decreases below the strike price.

Short put

A short put is a put options contract that is sold-to-open. A put options contract is sold when the underlying asset is expected to increase in price. Selling a put options contract means that the seller of the contract is obligated to sell the underlying shares at the agreed-upon strike price at the end of the contract expiration. A short put options contract is bought-to-close.

Put Options Example

For example, a trader expects Tesla (TSLA) to decrease in price following an earnings announcement, from $750 to $700. The move is expected to happen within the next two weeks. The trader buys one put options contract on Tesla at the $750 strike price, with a one-month expiration. The premium paid for this contract is $1,000.

Because an options contract controls the movement of 100 underlying shares, the break-even price for this contract would be $740. Tesla will need to move lower than $740 to offset the contract cost.

If Tesla grinds lower to $700, the call options contract will be worth $40 per share or $4,000, the difference between $740 and $700.

If you bought this put options contract, you would risk $1,000 to make $4,000.

Put Option Risk

Put options contracts are potent tools but are not without risk. As with any other type of options contract, long put options can and often do expire worthless. Selling naked options is inherently risky and should be avoided. Typically if a trader is selling options, they are doing so within a spread to generate income. To learn more about options spread strategies and how to generate reliable income, click here!

Put Options Assignment

In most cases, options assignment happens when a trader has sold an options contract and it expires in the money. In this case, if a trader has sold a put options contract and the underlying asset price falls below the strike price, the trader runs the risk of early assignment. Early assignment can happen at any time. If a trader has sold a naked put option and is assigned, his account would be debited 100 shares of the underlying asset. If the trader does not have those shares in his account, he will be short 100 shares of the underlying asset. This poses a substantial risk if the underlying asset price increases.

FAQ

A put option is a financial contract that gives the buyer the right, but not the obligation, to sell an underlying security at a specific price during a specified period of time. Put options contracts are purchased when the underlying asset is expected to decrease in price. Long put options contracts are profitable when the price of the underlying asset falls below the strike price of the contract. A trader can either buy or sell a put options contract to open a position.

A long put is a put options contract that has been bought-to-open. A put options contract is purchased when the underlying asset is expected to decline in price. A long put options contract is sold-to-close the position. A trader makes money on a long put option when the value of the stock decreases below the strike price.

A short put option is a contract that is sold-to-open. A put options contract is sold when the underlying asset is expected to increase in price. Selling a put options contract means that the seller of the contract is obligated to sell the underlying shares at the agreed-upon strike price at the end of the contract expiration. A short put options contract is bought-to-close.

Selling a put is known as a theta-positive trade. This means that as the put options contract expires, time is working for the seller instead of against the trader. When buying a call contract, this is known as a theta-negative trade. As the contract moves closer to the expiration date, the long call is losing premium value and will eventually expire worthless unless the price of the underlying asset rises above the strike price.