In 2020, I accomplished my goal of growing an $8K account into roughly $60K from July to September. Since then, I needed another challenge, so I started a project to grow a trading account starting with only $500. I started on December 28th, 2021, and by mid-February 2022, it had grown to $11K. This seemed to be an impressive feat, but the race isn’t over yet! My new goal by the end of 2022 is to grow this account to $100K.

I want to show you what it takes to reach such a goal and the discipline required to be successful because it’s no easy task. Trading can and will be tense.

Small Wins for Successful Growth

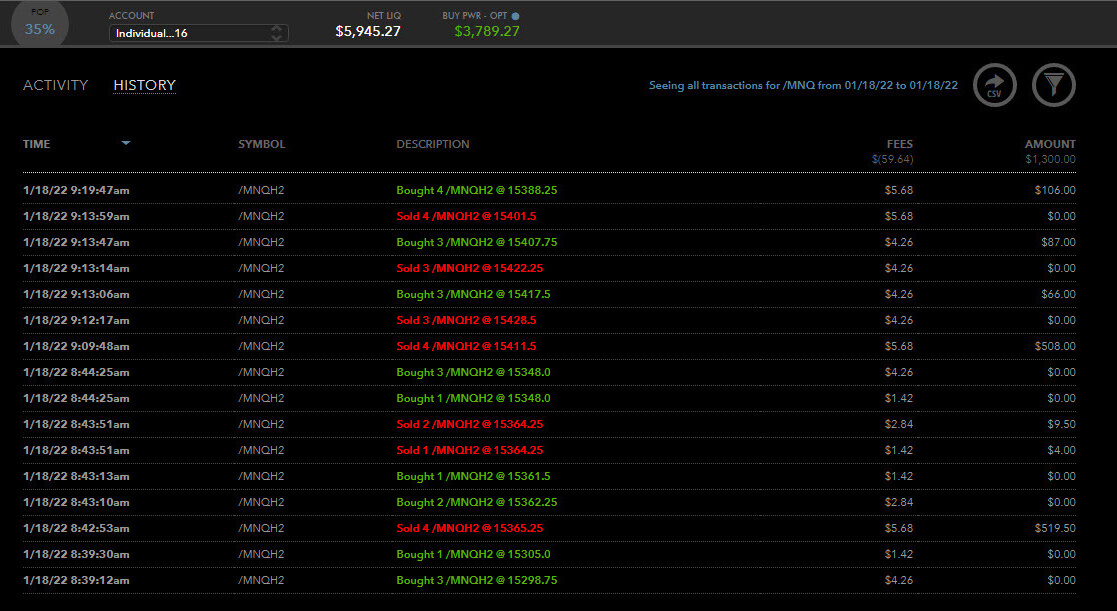

Small, consistent wins are needed to achieve this level of success. One of my favorite tools used to increase profit regularly is day trading Micro E-Mini’s. This strategy has worked well, consistently adding to my P/L every week. As you can see in the image below, I was able to add $1,047 in profit in a single day. This was accomplished by day trading the ticker /MNQ.

But let’s not lose sight of how to get a small account to $100K…

I’m going to share my journey over the last 18 months and shed some light on what’s possible versus what’s realistic in the current market conditions.

Being Flexible During Changing Market Conditions

It was the week of September 17th, 2020, and the elephant in the room was the rotation out of tech and the Nasdaq puking us into Triple-Witch Expiry. Now everyone shouts “yay” sarcastically, and let’s admit it – that was the vibe. However, I had a relatively successful week, even though I endured some losses that reminded me of my old trading days.

It was a little bit of crossing the fingers and hoping that due to the volatility, maybe AMZN would trek back up and the butterfly I placed earlier that week wouldn’t be worthless later on. Well, that didn’t quite work back then, and I stomached a complete loss.

Fast forward, now it’s February 2022, and all you see deep into Twitter’s horizon is record put selling, followed by a tiny flare of inflation fear; rinse and repeat.

One thing has constant, volatility is here, and it’s here to stay, even while on our way to a new phase of market personality.

It’s time to shift from directional options strategies to “take the money and run mode”. It’s either that or you’re light on your feet, ready to take small pounces. I take my small pounces with Micro-futures, and the good news is that volatility makes that easier.

So since we know that volatility’s here to stay, let’s talk about what it takes to grow a small account (and see if you’re up for the job).

How to Grow a Small Account: The Psychology

2020 had volatility, giant swings in the Nasdaq, and the dollar was “trying” to break out. It seemed like market internals were sloppy half the time.

2021 is what happens when another major institution steps in… called the Fed. It was the year of record call buying, high short-interest, and meme stocks. It seems there’s some residual strength remaining, but will we neglect the fact that tech and the general market- will cool off? Will cooling off mean a new set of prices across the general market?

So far, 2022, as mentioned above, has shown us that volatility’s going nowhere, and we need to adapt how we approach the market. But let’s stop focusing on the negative and pivot toward the positive. My small account is up in a major way, and I intend to grow it to $100K by the end of the year. I also want this to be my first 7-figure account by 2025. I consider this a realistic goal for how I trade.

Frankly, the better I trade, the higher the P/L.

It’s a common mode I enter once I start trading a 6-figure account. I naturally become more careful, tend to focus more, and my trading begins to shine. However, it’s not the same for everyone. I know several successful traders that are quite the opposite and tend to struggle as accounts grow larger. I think I’ve had my teeth kicked in one too many times in my 20s to start allowing bad habits to creep in again.

Here are the lessons I learned through that “good” teeth kicking.

Trading Lesson #1

“Trading’s a journey to the inner-self.”

Trading is an art. It’s an art in humility and life lessons, and even more directly to the core, it’s a game against yourself—a game I like to call discipline.

An easy guide for finding out what this means is to ask yourself, “what’s working and what’s NOT working.” Again, the level of accountability to yourself is the difference between “are you taking profits at 50% profitability” versus “it should just keep going, the money is secure.”

Hey Jack, I gotta tell you something: as a micro-futures trader and someone who grows small accounts, I sure do appreciate the gift of volatility bestowed upon ye gentle feet… but there’s something you must remember.

“As a trader, you must realize that managing losing trades is your job.”

Just because the beginning of the week starts off solid doesn’t mean the market isn’t going to try and rip your face off the very second you forget about your trading plan. Remember, if a trade you’re in is too good to be true, in this market – it most likely is.

What Worked For Me

Back in 2020, I began trading butterflies on NFLX, and, of course, scalping micro-futures (as we previously discussed)

I then continued momentum plays by buying delta 70 calls on high-volume options contracts on high beta stocks. I mainly traded ZM, TSLA, NVDA, DKNG, FSLY, and WKHS. The account was up to $30K, and I was focused but relaxed. I continued to trade consistently, taking profits early on bullish trades and managing small losing trades accordingly.

On January 18th, 2022, I profited over $1,300 trading micros on the /MNQ; here’s how it played out.

Opening morning extended hours created a dip that was very easy to anticipate. I planned to buy the dip based on the previous day’s strength. As soon as the bell rang, the market showed a strong reversal that was getting bought on every dip. There were no 10X bars that were green, but in this scenario, it makes sense for them not to print within smaller time frame squeezes. That was the most crucial part, it was a weak bearish overnight move, the bulls pounded hard, and we were there to take advantage of the squeeze.

Trading Lesson #2

“Euphoria will take you from reality if you let it.”

One of the main reasons why I like growing small accounts is that it requires the same level of discipline as going to the gym and consistently building muscle. Without discipline and consistency, it’s impossible to grow a small account.

There are other external factors to consider when growing a small account. Things like the day-trading pattern rule and lower buying power. These limitations may be frustrating, but if you can get past them, all the better.

Every time I grow a small account, I realize that position sizing and admitting losses are still the most important things to consider. So, as I continue to grow the trading account, I do not deviate from my trading plan.

3 Setups I Use To Grow a Small Account

The question: what exactly is working? Well, I’ll tell you what works for me. I have three key setups.

Setup # 1- Buying delta 70 calls in a lower timeframe (15 mins to hourly) bullish squeezes for an intraday momentum play. These trading opportunities usually present themselves when the 8 SMA (simple moving average) crosses the 21 SMA. I typically buy these call options the day of the cross-over or even the day after. These trades work even better if the market opens with above-average volume.

Setup # 2- Bullish put credit spreads, mixed with long calls in TSLA, to catch short covering rallies. These trades can be swing trades, or intraday momentum plays. Trader John Carter is known for these types of trades. To learn more about John Carter’s “squeeze”, click here

Setup # 3 – Options Trading on Micro Futures. Here are a few reasons why trading contracts on micro futures has helped me grow my small trading account consistently.

Trading Micro E-mini’s helps me:

- These trades offset small losses.

- They are consistently more profitable and add to the P/L.

- These trades have more exposure in a volatile market, allowing me to take a lot of smaller profits and, to my surprise, sometimes larger ones (even on only 2 or 3 /MNQ contracts, as discussed earlier).

With the current market conditions, “things aren’t as they seem”. While it’s fantastic to have quick gains due to volatility, limiting exposure with appropriate position sizing and sticking to your trading plan will be crucial to your success.

Growing Pains in the Market

There is little to no doubt that these are trying times. Understand, though, that volatility presents endless opportunities, and as an options trader, that is a great thing.

“I always say, be grateful for what the market gives you and move on.”

I’ll end with this- Over the years, John Carter has taught me two of the most valuable lessons: “trim it off; you’re probably wrong” and “your job as a trader is actually to be a professional loser.”

These lessons are paramount to mitigating risk. If you’re a new trader or struggling to be profitable, you may find these lessons hard to swallow.

“I say a small loser is still a winning trade.”

The longer you trade, you will learn that the markets are filled with paradox and irrationality. Your ego will prompt you to react negatively to circumstances to preserve itself. And when you find yourself deviating from your trading plan, a life lesson from the trading world will undoubtedly present itself, adding salt to the wound.

It doesn’t have to be that way, though. If you remain disciplined and stick to your setup-ups, trading can be enjoyable. Some call it the best “job” in the world, and that’s how it should be.

Like John Carter says, “making money in the markets is easy; holding onto it is the difficult part.”