In this post:

-

- What is one of the easiest trading platforms to use and teach to new traders?

- What is WROS?

- How many owners can an account have?

One of the most frequent, first questions I get when teaching others how to trade options is:

“How do I sign up for a Brokerage Account?”

Or more specifically:

“What type of account do I need to trade option spreads?”

Signing up for a trading account can seem like a simple thing to do, but oftentimes traders first signing up for an options account can find themselves thrown off by the language and questions asked. I know when I first signed up for my account, the questions threw me for a loop. It was not about my personal thoughts about trading, but rather about specific answers most trading platforms are looking for to help control their risk.

I have been with many trading platforms over the years, quite a few I was with before they got swallowed up by others like OptionHouse to E*Trade, and some that I have stuck with from the start. Most of the questions are shared across trading platforms, though some like to be a bit more sophisticated in their language. I think one of the easiest trading platforms to use and teach to new traders is tastytrade, and their sign up process is some of the simplest. So to keep in the spirit of all things simpler here at Simpler Trading, and to help those with questions about the sign up process, I am going to take you step-by-step and help clear some of the confusion, with pictures included.

The first step is to determine what kind of account you’re opening, or more specifically, who will have access to your trading account.

For most traders, it is typically Individual, which means you are the single owner. There is also Joint, where you share access and control of this account with another person. This could be someone like your significant other or perhaps family member, and this person would also have the ability to trade within the account. This can be broken down to With Rights of Survivorship (WROS) where both owners have equal share of assets and when one person passes, the surviving owner will have full rights to the rest. The other way a Joint account can be an option is Tenants in Common, where two owners each have a specific proportion of the account’s assets and when one owner passes away, their assets are passed on to their own estate. There is also the option of Entity/Trust. This is an account where there is a primary owner and then “additional owners” who are able to trade within the account. Most of these accounts are seen as professional and can be subjected to fees. As I stated at the start, most traders choose Individual Account, so that is what we will focus on here.

For most traders, it is typically Individual, which means you are the single owner. There is also Joint, where you share access and control of this account with another person. This could be someone like your significant other or perhaps family member, and this person would also have the ability to trade within the account. This can be broken down to With Rights of Survivorship (WROS) where both owners have equal share of assets and when one person passes, the surviving owner will have full rights to the rest. The other way a Joint account can be an option is Tenants in Common, where two owners each have a specific proportion of the account’s assets and when one owner passes away, their assets are passed on to their own estate. There is also the option of Entity/Trust. This is an account where there is a primary owner and then “additional owners” who are able to trade within the account. Most of these accounts are seen as professional and can be subjected to fees. As I stated at the start, most traders choose Individual Account, so that is what we will focus on here.

Out of the Individual Account, you will have three different options to choose from, and some can limit the ability of what you might be able to trade (like option spreads and other strategies). This is usually the first hurdle some options traders run into when opening their first account, so let’s break it down.

The first option is Margin Account, and much like the subtext states underneath, it is the most flexible kind of account. This type of account will allow traders to trade option spreads like Verticals and Butterflies, as well as uncovered calls. The amount of Risk will of course depend on how much margin you will be granted, which we will talk about a bit later in the sign up process. Just know you don’t need Elon Musk’s bank account size to sign up for this kind of account, but of course that also means you may not be able to borrow as much as Elon Musk can either.

The first option is Margin Account, and much like the subtext states underneath, it is the most flexible kind of account. This type of account will allow traders to trade option spreads like Verticals and Butterflies, as well as uncovered calls. The amount of Risk will of course depend on how much margin you will be granted, which we will talk about a bit later in the sign up process. Just know you don’t need Elon Musk’s bank account size to sign up for this kind of account, but of course that also means you may not be able to borrow as much as Elon Musk can either.

The second option is a Cash account. Most traders when first signing up for an account lean towards this option if it is not their IRA account they are trading out of, however this is where that first pitfall can appear. If you want to trade option spreads, or uncovered options, then this is not the account for you. Cash accounts are limited to buying stock and only long Call and Put Options. Oftentimes when newer traders know they are putting their own money into an account, Cash just seems like the logical choice, not fully understanding the limitations placed around those accounts by the brokerage platforms. Selling short strikes, even when it is a part of a spread, is seen as “Risky” due to the potential of getting assigned shares your account may not be able to handle because it is only limited to the exact amount of cash in the trading account itself.

The second option is a Cash account. Most traders when first signing up for an account lean towards this option if it is not their IRA account they are trading out of, however this is where that first pitfall can appear. If you want to trade option spreads, or uncovered options, then this is not the account for you. Cash accounts are limited to buying stock and only long Call and Put Options. Oftentimes when newer traders know they are putting their own money into an account, Cash just seems like the logical choice, not fully understanding the limitations placed around those accounts by the brokerage platforms. Selling short strikes, even when it is a part of a spread, is seen as “Risky” due to the potential of getting assigned shares your account may not be able to handle because it is only limited to the exact amount of cash in the trading account itself.

The difference between this and a margin account is in a margin account, you are telling the brokerage accounts that you have assets and more money at hand than what is just visible in the account. This gives the trading platforms “peace of mind” about your account getting potentially assigned shares, because you are telling them that there is more that you have than just what is in your trading account.

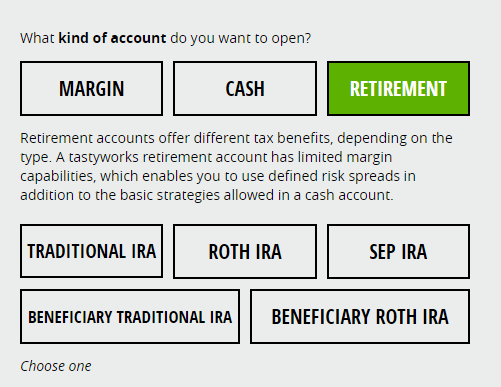

The third option is Retirement, which then is broken down into which type of IRA account you have: Traditional, ROTH, SEP, Beneficiary Traditional, and Beneficiary ROTH. Now most IRA accounts do have restrictions on the type of strategies that can be used, much like with Cash Accounts. This is because IRAs are meant to save up for retirement, so what the trading platforms view as “Riskier Strategies” may not be allowed. However, this can vary depending on the brokerage platform you sign up with. Don’t hesitate to call up and ask what type of option strategies are permitted and what size account you might need in order to trade some of the limited option strategies available.

The third option is Retirement, which then is broken down into which type of IRA account you have: Traditional, ROTH, SEP, Beneficiary Traditional, and Beneficiary ROTH. Now most IRA accounts do have restrictions on the type of strategies that can be used, much like with Cash Accounts. This is because IRAs are meant to save up for retirement, so what the trading platforms view as “Riskier Strategies” may not be allowed. However, this can vary depending on the brokerage platform you sign up with. Don’t hesitate to call up and ask what type of option strategies are permitted and what size account you might need in order to trade some of the limited option strategies available.

The bottom line for this portion is that if you want flexibility to trade any type of option spread from verticals to short options, then you will want to lean towards a Margin Account. For this purpose, we will continue here with “choosing” margin and continue with the sign up process.

Once you choose what type of account you want to open, you are then asked all the usual, personal questions: Name, Residency, Citizenship and all the other standard information you use when signing up for a bank account or credit card (and, no, your credit is not checked when opening a trading account).

The next step in the process is to answer some Affiliation Questions. Most of this will not apply to the average trader, and if it does, you were probably already aware of it before starting this process. Below are the questions that most brokerage platforms will ask you:

They of course will ask you these questions to make sure no “funny business” goes on while you trade and look to grow your account. You don’t want to find yourself like Martha Stewart and on the plot of an episode of Billions.

They of course will ask you these questions to make sure no “funny business” goes on while you trade and look to grow your account. You don’t want to find yourself like Martha Stewart and on the plot of an episode of Billions.

As I mentioned earlier, for most traders the answer is no to this question, but if you are hesitant at all, always feel free to call into the brokerage account company you are signing up with and I am sure someone would be happy to help address any specific questions.

Once you get through these questions you go back to some of the more basic information you may fill out at a doctor’s office like Trusted Contact. Now it’s time for the next “hard part”, another struggle area for newer traders who might get confused by the language. So let’s break down what the Brokerage platforms are really asking by these questions in this portion of the signup.

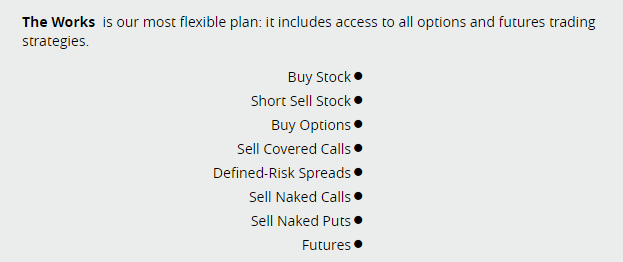

In tastytrade, they too like to make things simple by asking what you would like to do in your trading account. If you want to trade option spreads or naked options, then “The Works” is probably the best fit for you, as it is the most flexible account to trade out of.

After you tell them what type of account you would like, the next step is to confirm your knowledge level.

After you tell them what type of account you would like, the next step is to confirm your knowledge level.

Much like with anything else, the more knowledge you have on a topic, the more likely people are going to trust that you know what you are doing. You wouldn’t want to go get Heart Surgery from a Freshman Undergraduate debating between going into Medicine or Philosophy. This is how Brokerage platforms view the Risk they might be taking if they grant an inexperienced trader with access to Selling Naked Calls or Naked Puts.

Much like with anything else, the more knowledge you have on a topic, the more likely people are going to trust that you know what you are doing. You wouldn’t want to go get Heart Surgery from a Freshman Undergraduate debating between going into Medicine or Philosophy. This is how Brokerage platforms view the Risk they might be taking if they grant an inexperienced trader with access to Selling Naked Calls or Naked Puts.

If you are brand new to options trading and are still not even sure what a Call or Put is, you may want to pause here and start to consider some self teaching to get familiar with the subject you are attempting to do. Once you know you have more than “limited” knowledge, you can come back to filling out this part of the form. One great way I found to further my knowledge of trading without using real money was to first start off paper trading. This allowed me to grow my knowledge into that expert level without putting myself (or potentially the brokerage company) at risk with my real money. When I got comfortable with the strategies I was trading, I then was able to jump into real money. Keep in mind, the Brokerage Company wants the least amount of Risk on their end, so if you have an understanding of trading option spreads, they will be more likely to grant you that access.

The next place that new traders can trip up at is the “Trading Objective” question. I know for me, I struggled with this part when first signing up because my definition of how to achieve my “trading objective” was different than how the Brokerage platform defines their terms. Let’s break down each one to understand how the Brokerage platform is defining these answers. The way you answer this could determine whether or not your account will be able to trade option spreads or not.

The first answer that you can give is “Speculation.” To most traders who want to trade option spreads, this is the one to go with. When I first started to trade options, I saw it as a defined (and therefore limited) risk. This of course excludes selling naked options, something I have rarely done. Trading options typically also means that there is less capital needed than buying straight shares. However, this is not how the brokerage platform sees it, and you need to be mindful to answer to their definitions.

The first answer that you can give is “Speculation.” To most traders who want to trade option spreads, this is the one to go with. When I first started to trade options, I saw it as a defined (and therefore limited) risk. This of course excludes selling naked options, something I have rarely done. Trading options typically also means that there is less capital needed than buying straight shares. However, this is not how the brokerage platform sees it, and you need to be mindful to answer to their definitions.

For them, “Speculation” is options trading. There is a specific time frame that you are looking for a move to occur by. Most options traders are not sitting and holding trades for years at a time. Overall, trading options, and specifically spreads, to brokerage accounts means that you as a trader are looking for the “hope of a higher-than-average gain.”

The next answer that can be given is “Growth.” When the Brokerage Account mentions this term, it is usually focused on the bigger picture view and the appreciation of values in the account over a longer period of time. So when this selection is made, in regards to options it is typically focused on Long Call or Long Put plays, and can sometimes limit the option strategies that are available to trade.

After “Growth” is “Income.” “Income” is focused more on short term growth that covers expenses rather than the bigger picture view. As an options trader, you may think this is the pick for you, but once again we need to go off how the Brokerage Company views “Income”, rather than what we know we can do as options traders. The Brokerage Company typically views “Income” accounts to grow through bonds and dividends and therefore limit your ability to trade multiple option strategies.

The last choice is “Capital Preservation”, which I think is something every trader can agree on. No one wants to lose the money they are about to invest. This is usually viewed as the account taking the least amount of risk. Keeping in mind what was stated earlier, Brokerage Accounts view options trading, especially the ability to trade spreads, as very risky, so you can make an educated guess on whether or not you will be able to trade spreads in this account.

This is usually one of the big hurdles traders get stuck on because they are trying to use their definition versus what the Brokerage Account views as the “correct” definition of these account types.

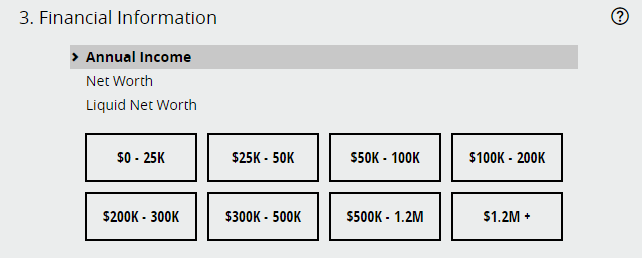

If you are opening a Margin Account, the Brokerage Company will also want to know what you have in regards to Income and Net Worth (both Liquid and not) so they can determine how much you will be allowed to have in “margin” to trade with.

As mentioned earlier, you don’t need to be Elon Musk to get a margin account, but the amount you make and have in Net Worth will affect how much margin the Brokerage Account will allow you to have. I personally use it as a rule to always trade within the cash means of what is in the account and not focus on the margin side of things, especially when trading smaller accounts. The way I like to look at it is that a margin account gives me the flexibility to trade option spreads and the strategies I like to use, but it doesn’t mean I need to necessarily dip into my margin to do so. This then allows me to keep my Risk in line with where I want it to be.

As mentioned earlier, you don’t need to be Elon Musk to get a margin account, but the amount you make and have in Net Worth will affect how much margin the Brokerage Account will allow you to have. I personally use it as a rule to always trade within the cash means of what is in the account and not focus on the margin side of things, especially when trading smaller accounts. The way I like to look at it is that a margin account gives me the flexibility to trade option spreads and the strategies I like to use, but it doesn’t mean I need to necessarily dip into my margin to do so. This then allows me to keep my Risk in line with where I want it to be.

Finally, after the “hard part is over” it is back to the basic routine of securing your account and confirming your identity. Oftentimes you will confirm your email address, as well as maybe showing a document that shows you live at the address that you claim to live at, like a bill.

Now, everything is complete! Grab that glass of wine and relax, and you will know soon (sometimes immediately and sometimes a couple business days later) if you were accepted for that account type and therefore are able to trade option spreads.

For those who are interested in signing up for a Tastytrade account, want to expand their trading education or tools, and have never used a Simpler Trading link to do so, you can sign up for a new account using this link here: simplertrading.com/AOTW

If you use this link and fund a TW account with at least $2,000, you can receive a $500 rebate to use in the Simpler Trading Store towards a class or indicator. This is a great way to gain that knowledge in options trading (or whatever trading you are interested in) while opening your trading account at the same time.

Hopefully this blog post gave you a bit more insight into how to sign up for a trading account that allows you to trade option spreads as well as decipher some of the language used by the Brokerage Platforms.

As always, may the trade be with you!