When considering going long on a stock, deciding when to enter your trade is one of the most critical components of your investing strategy. Chasing a stock after it’s had a significant run will diminish your upside potential. While getting into a stock that’s trading below upside resistance can lead to immediate losses.

Do You Need Help Picking Stocks?

There is so much that goes into picking great positions in stocks that it can get overwhelming for any trader. But, Simpler Trading recognizes that which is why they offer the top-performing MEM Edge Report which highlights winning stocks just as they’re poised to take off. You’ll want to read more about this twice-weekly report below, as last year, it had a 75% win rate among its stock picks.

What Does Going Long On A Stock Mean?

Quite simply, going long on a stock means that you are buying the stock that you then own of a particular company, with the expectation that the price is going to rise. Your long stock position and your funds invested will rise and fall with the price of that stock. The time frame or how long you own the stock will depend on several factors such as investment time horizon, your outlook on the stock market, or your exit strategies.

When to Take a Long Position

If you’re considering going long on a stock, one of the most important factors will be the general condition of the stock market. In other words, you want to make sure that the markets are in an uptrending period of strength that will help lift your stock higher. Without this backdrop, your odds of making gains on a long position diminish.

The markets do not fare well during periods of uncertainty. The positive and negative sentiment among investors causes stocks to bounce around as the bulls wrestle with the bears. In this type of situation, you’d be better served to wait for a healthier market backdrop before purchasing new stocks.

If the markets are in an uptrending phase, you’d want to make sure that if you go long on a stock, it is in a strong area of the markets. In other words, it’s in a sector or industry group that is relatively outperforming. Studies show that the sector and industry group affiliation of your stock accounts for almost 50% of that stock’s price movement. So getting a stock in a strong area of the markets will make a big difference.

In early 2022, beaten-down retail stocks seem to be coming into favor so that could be an ideal place to focus your research.

From here, once you identify a potential stock purchase, you’d want to make sure that the chart pattern of the stock is positive. In other words, is the stock above resistance and emerging from a sound base?

An Example of a Successful Long Strategy

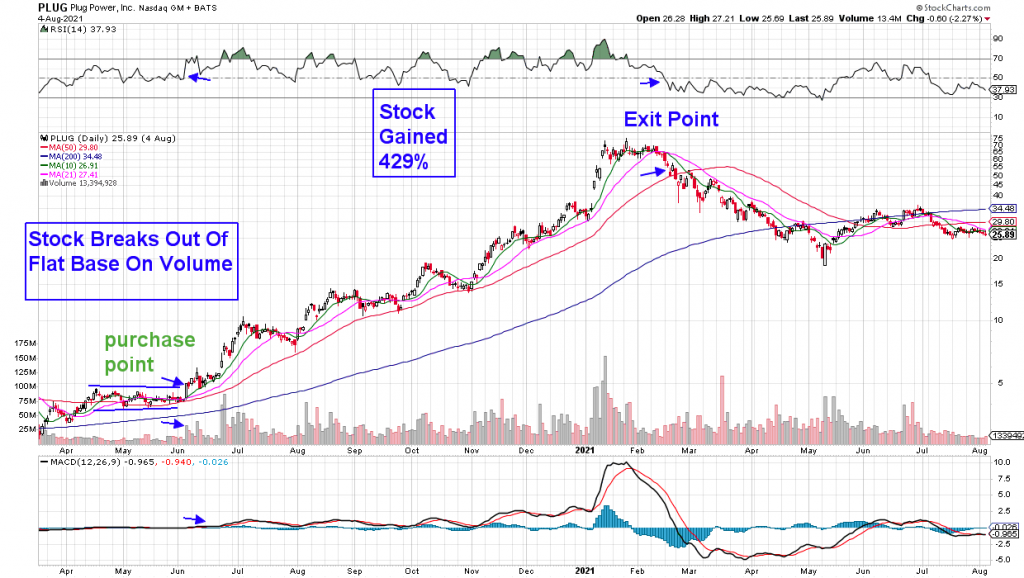

This skill of reading a price chart properly may take time to master but your time will pay off tremendously. Below is an example of my biggest winner in 2021 as the stock gained over 400% in an 8-month period. A marked-up price chart is below:

The entry point is highlighted above and as you can see, it was when the price of the stock rose above a 2-month period of back and fill price action. This is called a flat base breakout and when it occurs on volume (as it did above), the chances of that stock trading higher are improved. In addition, the new high in price at that time indicates that the stock is above any upside resistance.

Also, the company – Plug Power (PLUG) – is an alternative energy stock which was a group that was far outpacing the markets at the time of purchase. The group remained strong until the beginning of 2021.

My exit point in PLUG is highlighted above as well. And as the stock breaks below the simple moving averages lines (green, pink, and blue). You would not want to go long a stock as the lines are now upside resistance.

Trading stocks can be very exciting and even more importantly, very profitable. I’ve been educating professional and self-directed investors for years and teaching how to time your entry point when going long is one of the first steps on your way to becoming a successful trader.

For those who’d like to shortcut their way to becoming a successful investor, take a 4-week trial of my MEM Edge Report. This twice-weekly report does all the work for you, as it identifies top stock candidates poised to outperform the markets. More importantly, it explains why the stock is attractive so you can be educated on what makes a stock move higher than the markets.

FAQs on Going Long on a Stock

Q: What does going long on a stock?

A: It essentially means that a trader has bought stock in a company and owns their shares of stock. The trader now makes money as the stock rises. And if the company issues dividends for owning the stock, the trader can potentially collect.

Q: How do you take a long position on a stock?

A: To go long on a stock you have to obtain an account from a brokerage firm where you will have the ability to buy stocks.

Q: What is the difference between short and long positions in stocks?

A: Going short means that you think the stock is going to trade lower. It occurs when you borrow a stock and sell it on the open market, planning to buy it back later for less money. Going long quite simply means that you purchase the shares of the stock outright.

Q: What to consider before going long on a stock?

A: One of the most important factors to consider is the general condition: make sure that the markets are in an uptrending period of strength that will help lift your stock higher.