Traders get into the options market for a variety of reasons and most want to take advantage of the leverage that options provide. Out of my years that were spent teaching traders, in addition to my own adventure into options, I’ve come to know and love trading debit spreads in the options market.

It’s a common occurrence that many traders don’t consider learning. Instead, traders prefer sticking with more risky and volatile entry-level options strategies. I hear from traders all the time that they don’t know where to start and aren’t sure of the benefits of debit spreads. At Simpler Trading, we are here to help light the way.

What Are Debit Spreads?

A debit spread can also be referred to as a net debit spread. It’s an options strategy that consists of a trader buying an option with a higher premium and selling an option with a lower premium at the same time. This strategy is usually applied to long options positions to offset the cost of owning those types of positions.

Is Debit Spread Trading Right for You?

Well, it depends on your risk parameters and account growth goals. For me, I’m a conservative, directional trader, and I love trading directional charts. One way that I especially love to do that, is by using debit spreads. Let’s talk about the “Top 5 Reasons” why using debit spreads are beneficial:

Reasons to Use Debit Spreads

- One reason I like Debit Spreads is that they are cheaper than calls. You can’t change the price of a long call, you can only select varying strikes and expiration dates. With debit spreads, you can take the risk of a long call and cut a third of the risk-off by turning it into a debit spread. Debit spreads allow you to play directional setups on stocks where the long options may be too expensive or carry too much risk for you.

- Debit spreads optimize your risk to reward when compared to calls alone. With a spread, my platform tells me exactly how much I will lose if I’m completely wrong or if I’m right. I can adjust my strikes and number of contracts to allow me a 1:1 or 2:1 risk-to-reward situation, whereas on a long call it’s not as common that you can be risking one to make one or 100% on your long option.

- Debit spreads are more favorable for traders with small to intermediate size accounts ranging in the $5k to $75k. When you buy a long call or put, you are risking the debit paid – and generally a high one, at that. Due to the price of long calls and puts, retail traders without a six-figure account will see themselves quickly priced out of using this strategy, due to the risk and cost involved. A long call on a ticker like Tesla (TSLA) could cost you $5,000 – $8,000 or more. Spreads can be entered with a customized risk level down to $50 – $100 per trade.

- Spreads are easier on your P/L swings. Watching long debit and credit spreads allow you to make more consistent returns when you’re right and are much more forgiving when you’re wrong.

- Spreads work well in directional & volatile market environments. Understanding which strategies to employ in which conditions is critical. Lucky for debit spreads, they are a versatile strategy that works throughout conditions. Traders just must learn to adjust how they set them up, and where.

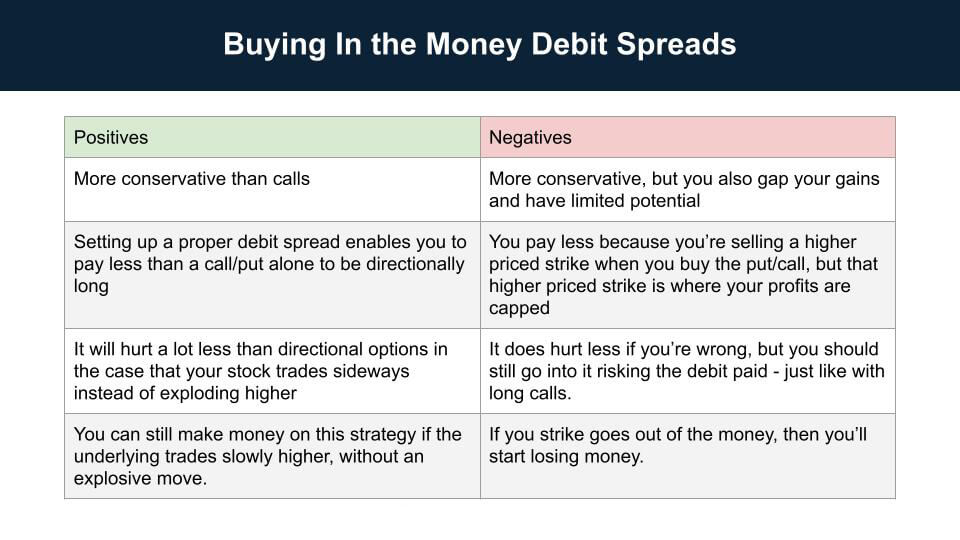

Check out this graphic for some core positives and negatives surrounding buying debit spreads:

How to Master Debit Spreads?

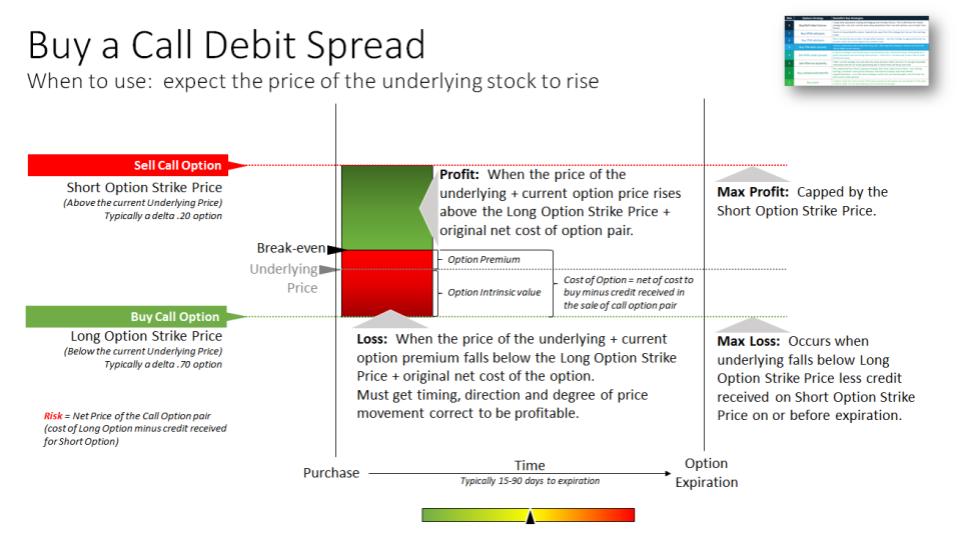

Knowing how and where you make your money is critical. However, mastering debit spreads can only be done by trading and with time you’ll begin to learn the ins and outs. If you are completely new to debit spreads and aren’t entirely sure how to go about them, paper trading is a practicable way to gain experience. Check out the graphic below to get a picture of where the money-making zone is and to gain a better understanding.

Most traders getting into options trading long calls and puts – which is a great place to start! But, traders can add knowledge to their tool belt with Debit Spreads, making mastery of the concept more efficient.

Examples of Debit Spreads

One of the best ways to learn how debit spreads work is for me to show you real-life examples of a trade that I have made. Below you will find Paypal (PYPL) for the example that I am using. Below you will also see the type of entry points you want to see and the setup that I have used.

Paypal (PYPL) – A directional, trend-following trade

On this ticker, I recognized the pullback, in the context of the trend. This, combined with my favorite consolidation breakout signal – the squeeze – told me it was time to set up a position to the long side in this ticker. I entered the trade when PYPL was pulled back on support, and I used a conservative debit spread as a small account trade.

In the example below, I bought two contracts for this debit spread. I bought the 109 strikes and sold the 118 strikes as protection. The total on this trade cost me a debit of $3.92 – so, a little under $800 total.

$118 was my target on Paypal. When PYPL hit $116.91 – very close to my technical target, I exited the trade for a market price of $6.67. This amounted to a $550 win, on an $800 risk. This is a great win for a small account!

Trading debit spreads is a great way to offset the cost of owning long option positions. But it can also be a fruitful trading strategy that can help you in your trading career.

🎯 Empower Your Options Trading Skills! 🎯

Take the leap and join our exceptional Options Trading Room for a Special Introductory Price of $7 for your first 30 days! Become part of a thriving community of passionate traders, observe expert traders in action as they conduct live technical analysis, interact with them in real-time, and gain insights from live trading. Stay up-to-date with our trade alerts and never miss important market developments. Click below to claim your spot and boost your trading prowess!

FAQs Debit Spread Trading

Q: What are the risk of Debit Spreads

A: The transactional cost of the debit spread itself and any other costs associated with the spread. You will have to take into consideration the reward minus the cost of the spread and any other transactional cost that could be associated. Debit spreads are considered to be less risky than naked calls and puts.

Q: Can I let debit spreads expire?

A: Unlike regular options, debit spreads do not expire worthless if you just let them run. This is due to the Theta Decay. Theta Decay is the rate of decline of an option as the option gets closer to its expiration date.

Q: Why would I use a debit spread?

A: Most traders use debit spreads to help them offset the cost of owning long options in their portfolio. However, they can be used as a less risky way to trade options.

Q: How do debit spreads work?

A: Debit spreads allow you to play directional setups on stocks where the long options may be too expensive or carry too much risk for you. By both buying and selling an option, a debit spread limits your risk.

Q: Is debit spread better than credit?

A: There are different instances where you would use debit spreads. Selling a credit spread can be the least risky way to play a directional chart.

Originally Published: Nov 21, 2017, at 10:15