In this post:

- What is the main driver of the energy sector’s prices?

- How did Hurricane Ida impact the energy sector?

- What are the two oil stocks to watch now?

Energy stocks are regaining their momentum from earlier in the year with the daily chart of the sector showing a reversal of its recent downtrend. As you can see, XLE broke back above its 50-day moving average in mid-September and is now poised to trade, and trend, higher.

DAILY CHART OF ENERGY SECTOR (XLE)

Oil Prices Drive the Energy Sector

The Energy sector has several drivers to its upside momentum and one of the first is the price of oil. This week, oil prices hit a six-week high as energy companies continue to struggle with output halted after Hurricane Ida made landfall about two weeks ago.

Going forward, oil prices are expected to remain at elevated levels.

In its latest monthly oil report, the International Energy Agency forecasts a rebound in global oil demand next month as the Delta variant of the coronavirus releases its grip on economies. It predicts continued growth through the rest of the year before beginning a slowdown next year.

With oil prices due to remain at higher levels, energy companies can continue to repair their balance sheets that were damaged from last year’s pandemic-induced slowdown in oil demand. Their increased cash flows are also being used to buy back shares as well as increasing dividends.

Two Energy Stocks to Watch

DAILY CHART OF DEVON ENERGY (DVN)

Devon Energy (DVN) is a prime example, as the company was the first to introduce a fixed plus variable dividend policy that boosts its quarterly payout by 44% in the 2nd quarter. Their 3rd quarter dividend is expected to be even higher.

The company is posting robust earnings as well with 433% year-over-year growth in its most recent quarter. The stock can be bought here at the $29.8 level on its way to a $30.5 base breakout, which would be even more bullish for the stock.

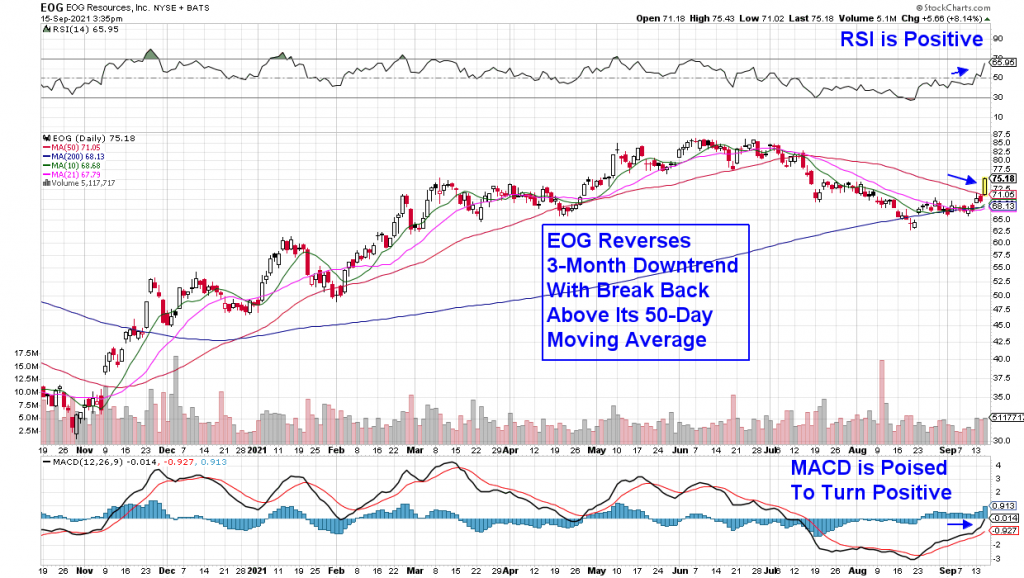

DAILY CHART OF EOG RESOURCES (EOG)

Next up is EOG Resources (EOG) which is known as the “Apple of oil” because of its use of technology and big data to aid in drilling operations. Their operations in south Texas and the Permains’ Delaware Basin helped the company beat analysts’ 2nd quarter estimates with an 852% increase in year-over-year earnings.

EOG broke back above its key 50-day moving average recently in bullish action. This key moving average can often act as upside resistance. EOG is poised to trade higher with its positive RSI on its daily chart and its MACD a hair away from turning positive.

Overall, mid-September’s price action in energy stocks confirms that the oil market sentiment has shifted as fears surrounding a lack of supply are now overriding fears around a lack of demand. Of course, a resurgence in Delta or another potential variant of COVID could change this, for the near future, oil stocks such as those mentioned above, are poised to trade higher.

If you’d like to receive alerts to sector shifts as they occur, complete with high-quality stocks poised to benefit, try my bi-weekly MEM Edge Report for 4-weeks. You’ll gain immediate access to my most recent reports as well as updated alerts as they’re released. Sign up today!