Why you need to know about covered calls

A covered call is a type of options strategy that leverages an investor’s holding of a stock position by selling call options against that same position. This strategy can provide an opportunity to generate income consistently. When selling covered calls, the max risk and reward are predefined, allowing option traders to allocate capital strategically. Before selling calls against your position, it is essential to understand precisely what a covered call option is, how they work, and when it may be a good option for you.

Key Takeaways

- A covered call option is a strategy that can be used to generate income from option premiums expiring worthless.

- The best time to place a covered call is when an investor expects neutral price action in the underlying stock to last until the strike’s selected expiration date.

- If an investor wants to partake in selling a covered call option, they must be holding a long position within the same asset.

- Covered calls are best deployed when an investor intends to hold the underlying stock for a long time regardless of stock depreciation and does not see a desirable price increase in the near term.

- Utilizing the covered call option strategy is best when the investor believes the underlying stock will not move much in either direction in the near term.

What is a covered call?

Selling covered calls is one of the most popular options trading strategies, not to be confused with a similar naked options strategy. Understanding the difference between selling a naked call option and a covered call is essential. The most significant difference is that the investor must have the underlying stock in their portfolio when selling covered calls.

The number of shares held also determines the number of call options available to be sold. The word “covered” indicates that the seller has the means to deliver the shares if the buyer decides to exercise their call option. Naturally, an option contract consists of 100 shares in a transaction. Therefore, you are eligible to sell one option contract per 100 shares held in your portfolio.

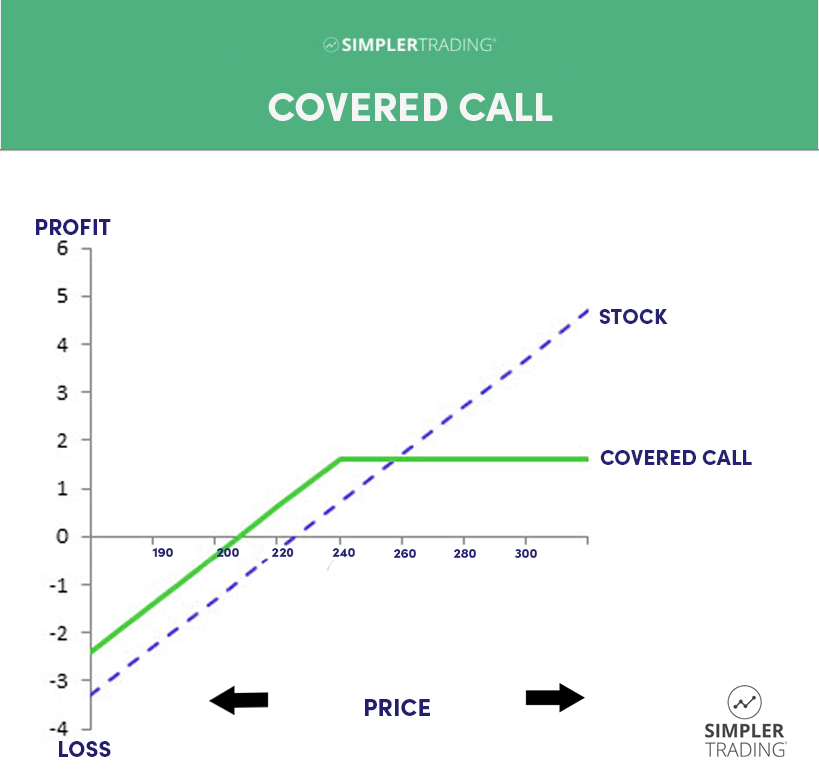

This strategy is a great way to lower downside risk while maintaining a long-term hold in a position. If done correctly and effectively, you can generate income while holding onto an asset for the long haul. Selling covered calls is best used when price fluctuations are part of your plan to hold.

Example of a covered call

If you own 100 shares of Tesla Motors (TSLA), you will be eligible to sell one covered call option. In this example, let’s say you own 100 shares of Tesla at $200 per share while Tesla is currently at $220 per share. These would be the possible outcomes if you were to sell a call option at the strike price of $230 per share with ten days until expiration.

The first outcome that could take place would be the share price of Tesla exceeding $230, and the option buyer exercises their contract to buy your shares. You would receive the stock appreciation value of $230 per share, along with the premium the buyer paid to own the option of your shares.

The second, and the best, outcome would be if Tesla were below the strike price of $230 and above your share price of $200. This outcome means that you will hold onto your shares and the option premium once the call contract expires worthless. In this situation, you have effectively made money on the options strategy without losing money in the long-term position of shares.

The last and least preferred option is when the share price falls below your average share price minus the option premium of this trade. Theoretically, Tesla falls below $200 minus the premium, and you will have netted a loss during this time. As an investor, you will still gain the premium from selling the calls, but the gain will be offset by the loss in equity of the underlying stock.

How to use a covered call

The first step to utilizing this strategy is obtaining at least 100 shares. An investor is eligible to sell one covered call option per 100 shares in their portfolio. For example, if you own 525 shares of Tesla, you are eligible to sell five call options that will be “covered.” Selling a naked call option incurs far more risk than a covered call. Are you looking for opportunities to identify trades that may work well for this strategy? Check out our newsletters!

Why should you use a covered call?

If you are holding underlying stock for a long-term hold but don’t see the value increasing dramatically in the short term, selling calls may be an opportunity to generate income through option premiums.

Another reason to use this strategy is to select a strike where you would be satisfied to sell the stock if the contract buyer chooses to exercise the option. In this case, you would lose your stock and future profit potential.

This strategy is also best suited for investors willing to sit through draw down on their stock over time.

Conclusion

As a long-term investor, this strategy is a popular way to generate income while holding onto the underlying stock. Utilizing the covered call strategy is preferable due to the inherently lower risk than other options strategies. The best time to place a covered call option is when you think the stock will not go up or down dramatically. In addition, ideally, you would plan to hold this stock long-term regardless of price fluctuations. Check out this calculator to see how a theoretical trade might perform.

FAQs

Yes, a loss can occur if the stock price rises below the break-even point. In addition, there is also an opportunity cost at risk. As an investor, you can lose the potential for capital gain through the stock’s rise over time.

A covered call works by selling a call option of the underlying stock held within your portfolio. It is important to note that you must have at least 100 shares per contract sold. The profit in premium occurs when the covered call expires worthless. For the trade to be profitable in its entirety, the underlying stock cannot drop below the buy price of your shares minus the premium collected.

No, it is not guaranteed money. There are two ways to lose using this strategy effectively. One is an opportunity loss, and one is a monetary loss. If the stock you choose to sell increases beyond the break-even point and the option buyer decides to exercise the option, you will lose the opportunity for potential future gain. If the stock drops below the amount covered in the premium, you will keep the stock, and the premium will be collected, but the payment of the premium received and the loss of the stock holding will net a negative return in that time.

The downside of utilizing the covered call options strategy is that there is a relatively small amount of income to other strategies that won’t risk losing your stock. For example, if you think the underlying stock will drop, a naked call option may be a better hedge for your portfolio. Also, you can potentially lose the right to your stock and the future capital gains over time, which was likely the reason for owning the stock in the first place.

Depending on what you think the stock will do, this question may be answered with different strategies. If you believe the underlying will see an upside move shortly, this strategy may be inferior to a vertical call spread or naked call option. In addition, if you think the stock will go lower, a vertical put spread or naked put option may be better. Also, you will not lose your right to own the stock as an investor.