In The Money Options

What Is In-The-Money?

The term in-the-money (ITM) describes an options contract with intrinsic value. Intrinsic value is derived from the difference in strike price and underlying asset price. If an options contract is in-the-money, it can be exercised at any time before expiration. The deeper in-the-money an options contract is, the higher it’s intrinsic value will be.

Key Takeaways

- In-the-money(ITM) means that a contract has intrinsic value.

- For a call option to be ITM, the strike price must be below the price of the underlying asset.

- For a put option to be ITM, the strike price must be above the underlying asset price.

- ITM option contracts are more expensive them out of the money options.

- In-the-money is the opposite of out-of-the-money .

Options Premium

Options buyers pay a premium when they purchase an options contract. The premium spent on an options contract depends on whether the options contract is in-the-money (ITM), at-the-money (ATM), or out-of-the-money(OTM). Other variables include the time left until expiration and implied volatility. The premium paid for an options contract indicates market participants’ value placed on that contract.

In-The-Money Options vs. Out-Of-The-Money Options

The adage “you pay for what you get” is especially true when buying options with intrinsic value. In-the-money options typically require more premium than options contracts that are out-of-the-money (OTM) because they have intrinsic value.

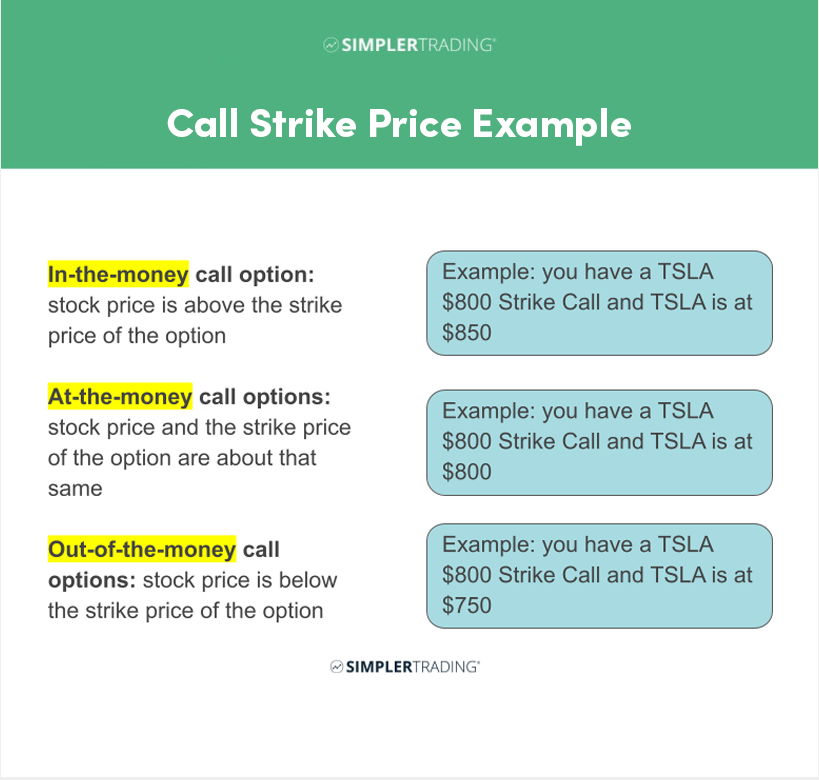

An out-of-the-money options contract is the opposite of an in-the-money. An options contract that has no intrinsic value is considered out-of-the-money .

If a call option’s strike price is above the price of the underlying asset, it is out-of-the-money . If the owner of this call contract choses to exercise it, they would buy the shares for more than they’re worth.

If a put option’s strike price is below the underlying asset’s price, it is out-of-the-money . If the owner of this put contract chooses to exercise it, they would be required to sell the underlying asset for less than it’s worth.

Since exercising out-of-the-money options contracts is never beneficial, they are typically allowed to expire worthless.

Intrinsic Value

Options premium is derived from an options contract’s intrinsic and extrinsic value. In-the-money contracts have intrinsic and extrinsic value, whereas out-of-the-money options contracts only have extrinsic value.

In-The-Money Call Options

A call option buyer is bullish on the direction of the underlying asset. The call option contract gives the buyer the right, but not the obligation, to purchase the underlying asset at the agreed-upon strike price before contract expiration.

A trader who buys a call option expects the underlying asset’s price to rise above the strike price before the option’s expiration date. A call options contract is in-the-money if the underlying asset’s price is above the strike price.

In-The-Money Put Options

A put option buyer is bearish on the direction of the underlying asset. The put option contract gives the buyer the right, but not the obligation, to sell the underlying asset at the agreed-upon price before the contract’s expiration. A call put options contract is in-the-money if the underlying asset’s price is below the strike price.

What happens when options expire in the money?

If an options contract is in the money and nearing expiration, it is almost always to the benefit of the contract owner to sell the contract, regardless if the trade has been profitable. If the owner of the contract does not sell before expiration, the contract will be assigned.

When a call option contract has been assigned, the trader’s brokerage will automatically exercise the contract on behalf of the trader. The brokerage will purchase 100 shares of the underlying stock on behalf of the trader. If the trader’s account does not have the required funding, the shares may be purchased on margin, or the broker may attempt to contact the trader.

To learn more about option trading fundamentals, consider joining the Simpler Trading Free Trading Room. We recognized an opportunity to help bridge the gap between inexperienced traders and experts. The Free Trading Room allows new traders to interact with our expert traders.