Novice trader confronted with harsh reality: PDT Rule

If you’re like me, you may have learned about the exciting potential of day trading and thought to yourself, “eureka!”… only to find out later that you needed a cool $25k to avoid violating some regulation you had never heard of before.

Honestly, I just didn’t have that much capital to start, and I knew it would be a while before I did. So, I started searching for ways to get around the PDT rule. I found a lot of “solutions” from trading gurus– “use brokers in other countries, get an offshore bank account, open multiple trading accounts!” But after further digging, I learned that some of these suggestions may still result in a violation and others seemed risky at best.

If you have found yourself in this situation, you may be asking the same question: how to day trade without than $25k, and not violate the Pattern Day Trader (PDT) rule.

I was surprised to learn that the solution is simple and doesn’t involve skirting the law, being married to the speaker of the house, OR using some unscrupulous broker.

What is day trading, and why do you want to do it so badly?

Day trading is the closest thing I’ve ever seen to making money appear out of thin air, or so it seemed. Once the dollar signs in my eyes went away, I quickly learned that there would be much to learn about trading strategies, indicators and risk management. If I didn’t take this seriously, I would end up like the 90% of traders who blow out their account in the first year.

“Oh great! I found my dream job, but it’s almost impossible, and I don’t have $25k “

me as a new trader

Still, I didn’t let this stop me. I felt desperate *ahem* confident enough that I could learn how to trade profitably; I just needed to find out how to get started without violating the PDT.

So, what is a day trade?

Technically speaking, a day trade occurs when a trader opens and closes a trade in the same security, in the same trading session. TD Ameritrade calls this a “round trip trade” and will alert any trader who executes a round trip trade and has less than $25k in net liquidating value (NLV) in a margin account.

The notifications within TD Ameritrade’s platform, Thinkorswim, become more prominent with every potential violation. These warnings culminate with a final warning that requires you to accept an acknowledgment of the violation. The underlying tone of the message is very ominous- “this account may be flagged as a pattern day trader account.” And make no mistake about it, on the 4th round trip trade within seven days, Thinkorswim will block you from opening new trades and flag your account. Goodbye Wall Street, hello Wendy’s!

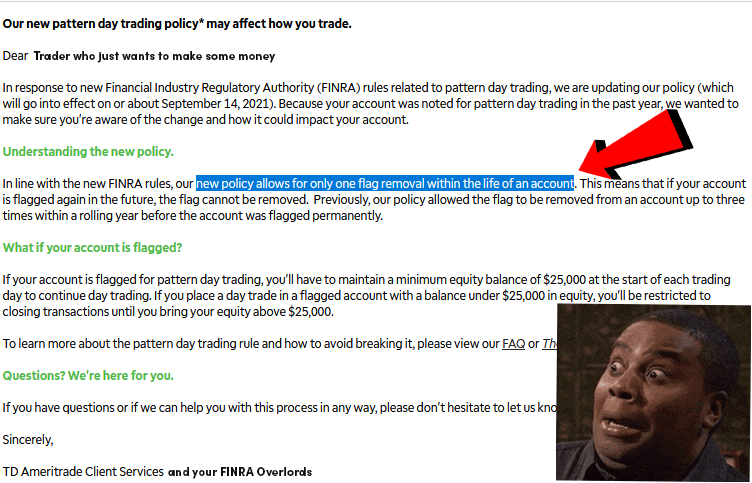

For years, Thinkorswim allowed forgiveness up to three times per year on accounts flagged as PDT, but in 2021, that was reduced to once per account lifetime. Translation: if you even dream about day trading in a margin account, your account will be locked until you bring the balance above $25k.

Pro tip: Do you know what’s better than asking for forgiveness? Not breaking the PDT rule to begin with!

How to avoid getting flagged as a PDT account

The key to avoiding the PDT rule is selecting the right trading account type. There are two options: Margin, the default selection, and a cash account.

Margin Accounts

In short, margin accounts float your account balance while transactions clear. There is a two-day settlement period in most option trades in publicly traded companies listed on the Chicago Board of Exchange (CBOE). Without a margin account, your purchasing power would be reduced during the two-day settlement period. Because a margin account temporarily borrows broker funds for settlement, it is subject to PDT regulations. Day traders who use margin accounts are compelled to abide by these regulations or potentially be fined by the Financial Industry Regulatory Authority, aka FINRA. So, unless your name rhymes with Pancy Nelosi, you may want to consider using a cash account.

Cash Accounts

Cash accounts do not settle on margin, meaning they are not subject to the PDT regulations. This is excellent for traders want to day trade but don’t have $25k. If your trading account has $6k and you use $3k to trade, you will only have the remaining $3k available to trade that day. Cash accounts settle overnight, so buying power is replenished the next trading session after a trade is closed, plus or minus your proceeds from the previous trading day.

Managing Risk in Cash Accounts

As with any day trading strategy, finding the right risk management strategy for your comfort level is essential. If you’re reading this article, it’s possible that you’re a novice trader and haven’t dialed in your risk management strategy. This entails finding the right amount you’re willing to risk on each trade. If you have a $6k account, choosing a trade that costs $3000 doesn’t leave much room for error. However, if you limit the amount of each trade to no more than $200-$500, you may be more comfortable with the position sizing and have plenty of room for error if the trade doesn’t work. Using appropriate position sizing and a high-probability trade setup can drastically reduce the probability of you blowing out your trading account.

In Summary

The best way for new traders to avoid violating the PDT rules is by using a cash account. Margin accounts can be used for trading but are subject to the PDT and are not suitable for day traders with less than $25K NLV in their accounts.

Want to avoid the dreaded 25k “day trading” rule limitation? Allison Ostrander’s Small Lot Trading Room is designed to do just that. It’s built off of the strategy that allowed her to grow a modest $10k account into $43k in about 90 days. It’s ideal for traders who seek consistent weekly gains with limited time and capital investment!

Happy trading folks,

Cody

FAQS

Open a cash account with T.D Ameritrade. A standard options trading account uses margin as a method to clear transactions. Because of the PDT rule, traders without 25k are not allowed to day trade using margin. A cash account solves this problem. All transactions clear overnight and your funds are available the next trading day. Unfortunately, cash accounts cannot take spread trades, however, they are perfect for directional trading.

Consider swing trading, position trading, or scalping. These strategies involve holding positions for longer periods of time than traditional day trading and may require less capital.