The stock market can be a challenging and complex field, particularly for novice traders who may struggle to decipher the vast amounts of financial data and understand the numerous factors that can affect market trends. Thankfully, there is a platform that has revolutionized the way traders research and analyze stocks: Finviz.

Finviz s an online platform that provides traders with a wealth of statistical data related to the stock market. What makes it unique is that it offers all of this information for free, making it a valuable resource for those who want to stay informed on the latest market trends without incurring significant costs. From market news and charts to the Finviz stock screener and heat maps, Finviz has everything traders need to make informed decisions about their investments.

For traders who require more advanced tools, Finviz offers a premium service that provides access to additional features, such as real-time market data, more in-depth analysis tools, and customized alerts. This option is ideal for traders who need to stay on top of market trends and make informed decisions quickly.

In the Finviz free version, you will access features such as news feeds, Finviz stock screener, stock charts, portfolio management, and the Finviz map, among other trading tools, to help you research the market. Whether a casual or a professional trader, you can use the screener to help inform your decisions.

What Does Finviz Offer for Traders?

Finviz offers several features when you need to make a serious trade. It gives you everything you need to conduct your analytical research. Finviz does offer technical resources, but its true value is its stock screening capabilities that can help traders find potential stocks to run their technical analysis.

How Does the Finviz Stock Platform Work?

The platform is a browser-based research tool where you have access to the most informative data in the stock market. You can go on the website for free, or you can sign up for a paid subscription with Finviz Elite. The only difference is that the free stock screener Finviz offers ads. The Elite Finviz stock screeners are free of ads, provide more tools for your research, and have a better user experience.

However, the ads are not overwhelming, even if you try the free version first. Still, if you start professional trading, you may need the convenience of not being distracted, which comes from the Elite version.

On the Finviz homepage, you will many different options:

- Search Bar for tickers and company profiles

- charts

- Graphs

- News

- Maps

Finviz Stock Screener

The Finviz stock screener is a sophisticated tool that can show you how the major indices are faring and who the biggest gainers and losers are on that day. You will also see information on where the site detects technical signals, especially where there is unusual volume, insider activity, and volatility. Details like oversold stock, new lows, and others will help you discern the best stocks from the rest. You can define the metrics under which you want to filter stocks. When you apply several metrics, the list of stocks gets narrower. If you use Finviz stock screener, you can use metrics, such as:

• Price-to-earnings

• Market capitalization

• Price

• Dividend yield

The Advantage of using Finviz Stock Screener

The Finviz stock scanner is one of the market’s most effective stock analysis tools. It’s fast and powerful and brings in-depth search options. When you get to the Finviz options screener, you can choose one of three types of filters:

• Descriptive

• Fundamental

• Technical

Descriptive

Descriptive filters allow you to pick a stock based on earnings data, market cap, dividend yield, industry, country, average volume, and price, among other factors. You can use these filters as the first step to cutting down the list of stocks.

Fundamental

The Fundamental filters will allow you to filter stocks based on even more important details. You can filter based on margins, P/E ratio, EPS growth, insider factors, quarterly sales growth, and many more. Most of these factors show a company’s projected future performance.

Technical

The Technical filters are your third option. You can use them to pick the best stock based on factors such as gap, moving averages, volatility, percentage change, after-hours change, performance, and RSI, among other factors. There is a limited number of indicators that can be used for technical analysis.

After filtering the stocks, and you only have a few that meet your criteria, you can choose how you want to see the results:

- Overview – Here, you will see the company details on the market, such as their name, sector, price, and market cap.

- Valuation – This shows you several ratios to help you decide whether you are dealing with the right company.

- Indicators – You will see a company’s financial health based on gross margins, earnings, and dividend yield, among several other pieces of information.

- Ownership – Check out details on institutional ownership, including outstanding shares and short ratios.

- Performance – See how the stocks have performed over time with details, such as volume and volatility.

- Technical – Details, such as RSI, lows, highs, and moving averages help you see how stocks are doing and how they are projected to perform in the future.

- Finviz Charts – Check out the visual patterns about the stock trends. The patterns give you a great way to analyze several stocks without a hassle.

- Tickers – Here, you will see the performance of tickers in a visual representation. Hover over the ticker and see more details on the small chart that appears.

- Basic – These results bring you a technical chart accompanied by a small table with an overview of the company.

- TA – This tab also shows you a small table with technical details but with more focus on the performance of the stocks.

- News – Check out what is happening on the market with the stocks you are interested in. You can also see what is happening in the sector.

- Snapshots – allow traders to explore a company profile and check out insider details.

- Customize what you See – The Custom tab allows you to pick the specific details that you want to see about certain stocks. After you see the view, you can save it for later.

Finviz Maps

The visuals on these Finviz market maps will help you assess the performance of the markets by seeing where the most activity falls. With Finviz Maps, you can see how prices change in different sectors and industries.

The information is presented in the form of a graph. You can see boxes in different sizes representing the market capitalization of the stocks and industries. These graphs can show data from different periods, including volume, earnings, PEG, and P/E among others.

Finviz News Page

From the homepage, you will go to the News page. This page brings you the latest news about the US stock market and the main players in the market. You can check out several articles about the market and see what catches your eye.

You can search for news about a specific company. You can keep tabs on that company and get notifications whenever there is a report about the selected company. It is essential when you are looking to monitor the media health of the company you invest in and observe if there is positivity or negativity surrounding the company.

Access Finviz Groups

The Finviz Groups tab brings detailed information about stocks by market cap, sector, or industry. You need to understand how stocks in a group perform before investing in one stock. The assessment helps you determine where the assets are compared to the competition by checking on performance and valuation. You can check the performance for a specific time frame. Through the tab, you can see the current condition of the market.

Keep Records on Finviz Portfolio

Keeping organized is essential to trading; traders can be organized in the portfolio section. You can access the portfolio for free, but you must sign up for an account. This feature allows you to record details of the stocks you buy or sell, the price of the stock, the date of the transaction, and any other relevant information about your portfolio. Finviz will then help you keep track of the stock added.

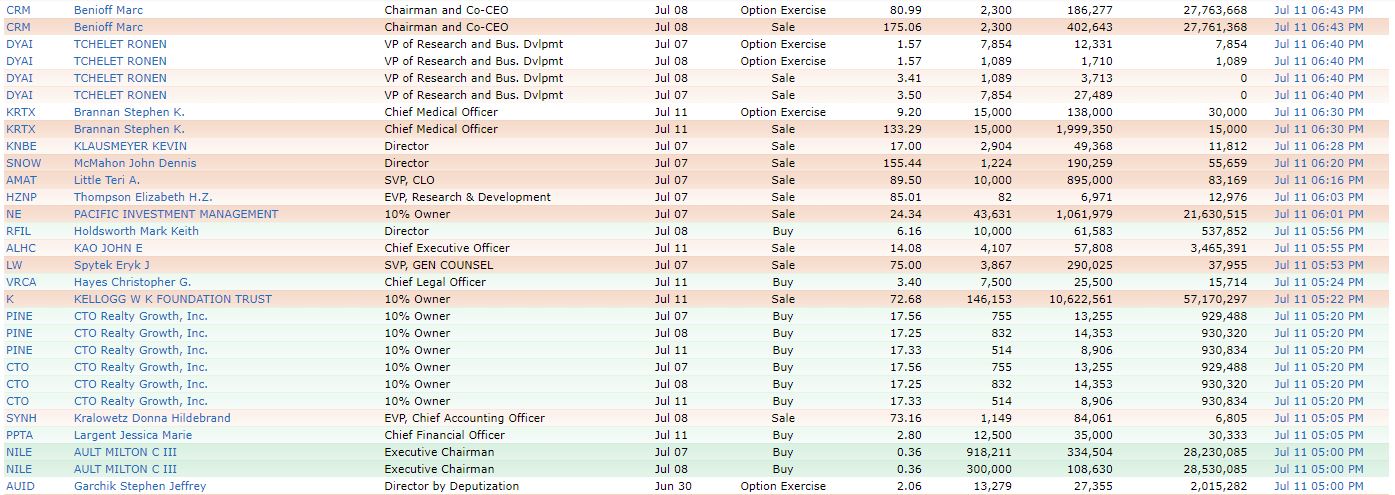

Explore Finviz Insider Tab

The tab helps you monitor any transaction an executive or a director makes on their publicly listed companies. If executives are buying their stock, you can see how much trust they have in their company’s growth. If the executives start selling their shares, it might be an indicator, but keeping tabs on what’s happening within can foreshadow the stock performance.

Finviz Futures, Forex, and Crypto Tabs

The future tab shows you the future market prices and charts. You will see information on sectors, such as energy, bonds, metals, currencies, and grains. The report appears in the form of a Finviz chart.

The forex tab shows you currency pairs, including GBP/USD, EUR/USD, USD/CAD, Gold, and CRUDE OIL, among others. For the forex tab, you will see quotes, chart data, and performance, among other details.

The Crypto tab will show you the price of different cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and many more.

Conclusion

Finviz is a great resource to utilize when conducting your analytical research. It offers a robust set of options that can help you find stocks that meet your criteria to make a trade. The visualizations make it easier to understand and are ideal for stocks in different sectors.

FAQs on Finviz

A: Finviz is a stock screening app that gives you detailed information about stocks to enable you to invest correctly. It presents the information in graphs, charts, and more for you to understand easily.

A: Swing trading involves buying stock and holding it for a while before selling to gain from the small price moves. For Finviz, you can use Descriptive and Technical filters, such as Market cap (over 2 BN), current volumes > 1m, and optionable.

A: To get the best results for day trading on Finviz, you need the Elite subscription. This Finviz account gives you access to several customization options and offers real-time quotes for your day trading. Go to the screener tab and enter:

• Exchange = Custom = NYSE + NASDAQ

• Set the average volume

• Set relative volume

• Choose the industry

• Set current volume

• Set the price range

A: Open the screener tab and go to the All tab to see more categories. Check out the price category and set the price. Say below $5. The next category should be 52-week high/low, setting the cost down and high (0 – 3 %). You will see the stocks that you can invest in below the categories. Once you choose the stock, you can check out other indicators.

A: You can set up your Finviz account on the Descriptive and Technical tabs to identify stocks that will give you fast gains within a short period. You can, for instance, use Technical filters to find the best trading patterns for different stocks. These patterns will show you when to get in and out of the market.